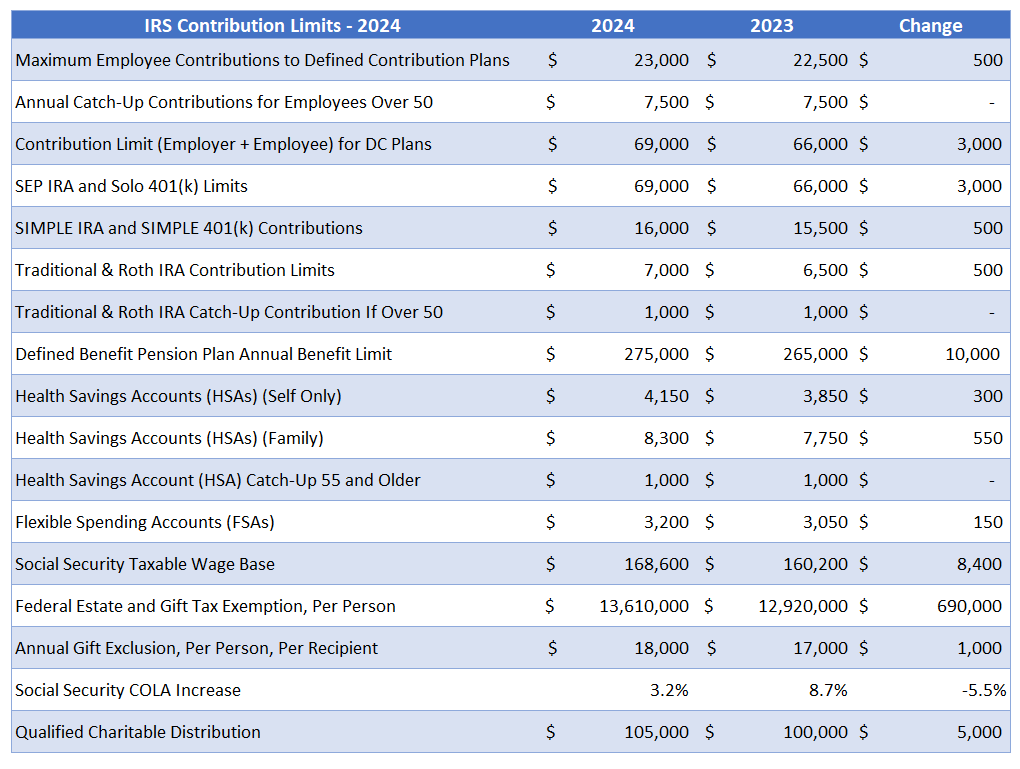

Irs Deductible Limits 2024 – The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . Find out everything you need to know about 2024 tax brackets, from how they work to how they’ve changed and how they impact your tax liability. .

Irs Deductible Limits 2024

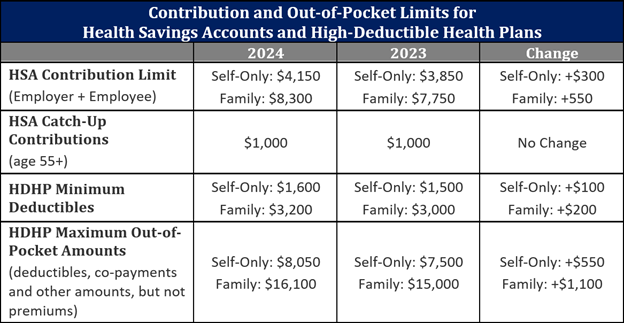

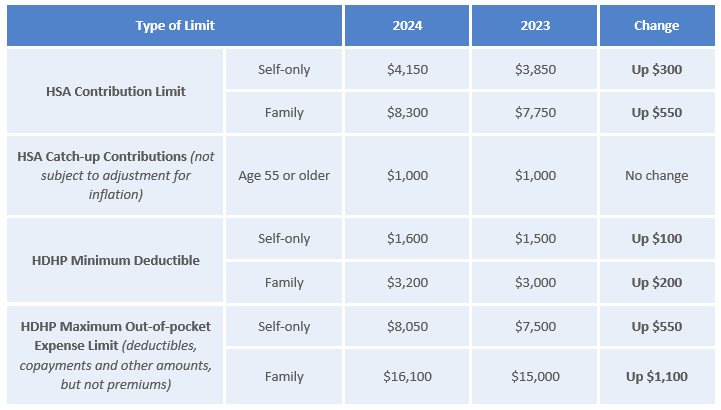

Source : www.keenan.comSignificant HSA Contribution Limit Increase for 2024

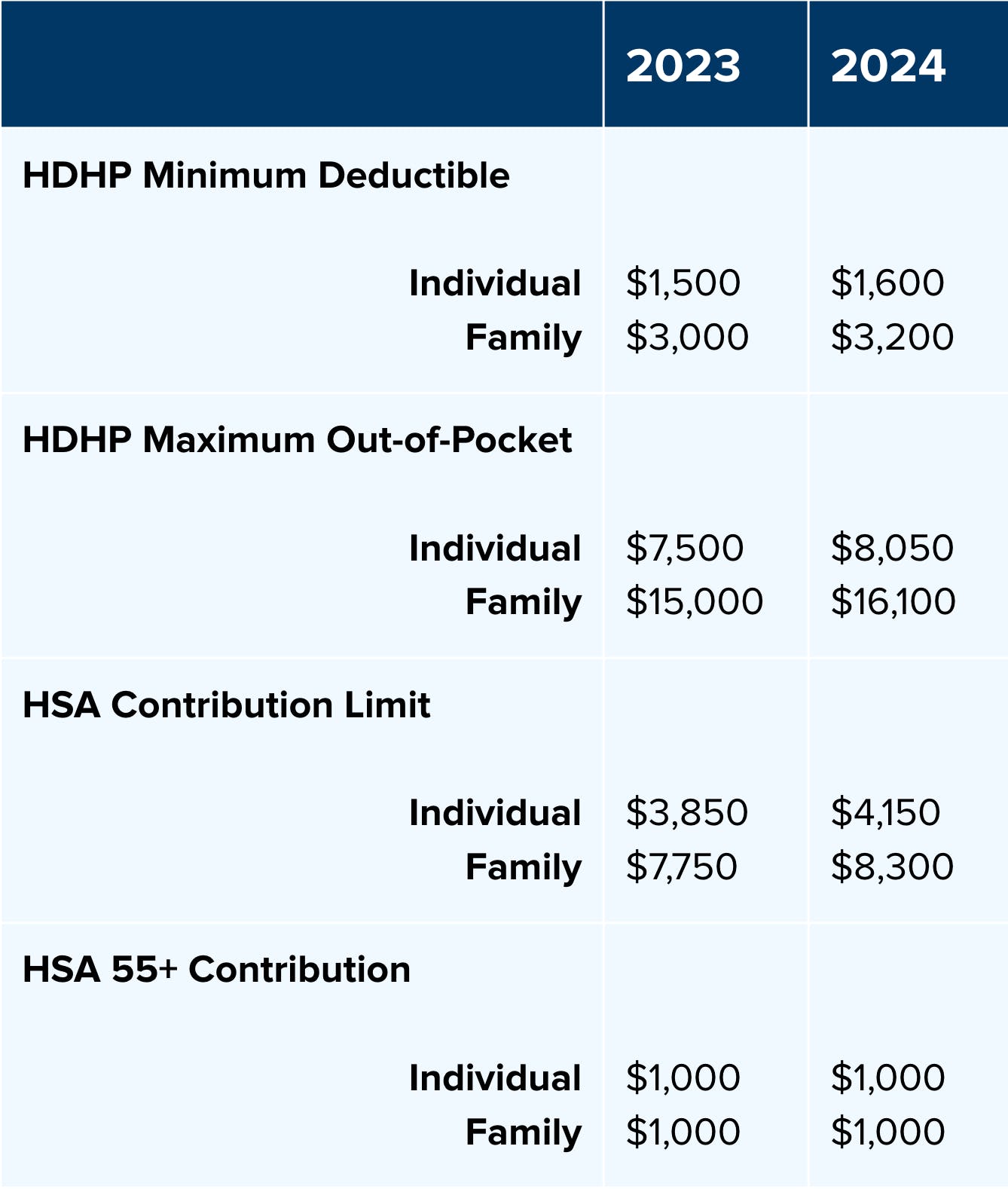

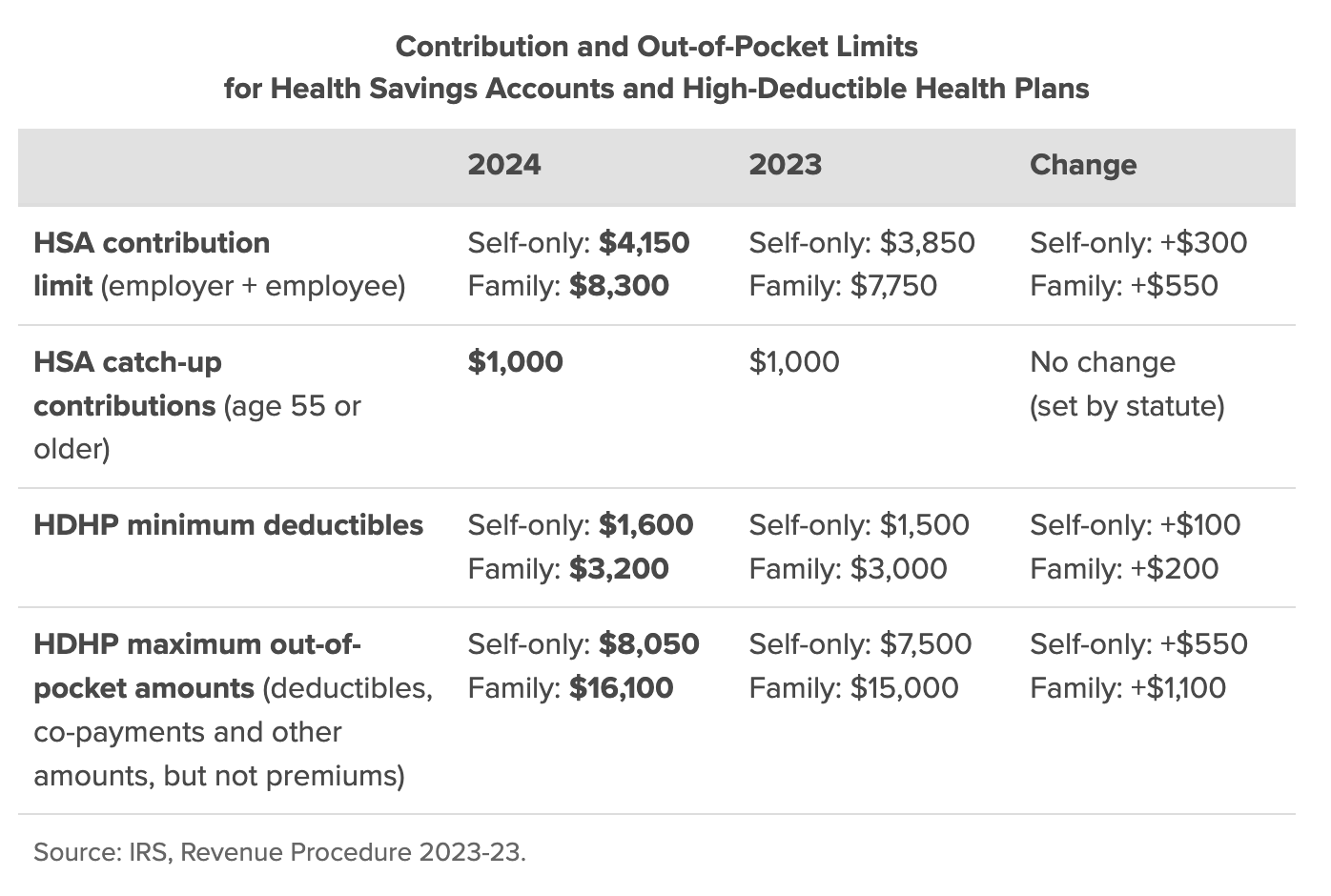

Source : www.newfront.com2024 HSA Contribution Limits Claremont Insurance Services

Source : www.claremontcompanies.com2024 IRS Contribution Limits For IRAs, 401(k)s, and More

Source : darrowwealthmanagement.comNew Limits for Long Term Care Premium Deductibility Issued by IRS

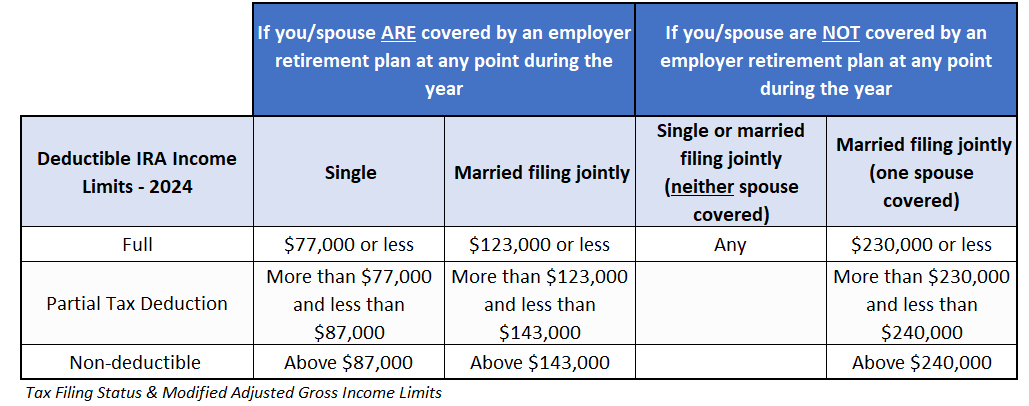

Source : newmanltc.com2024 IRA Tax Deduction Income Limits | Darrow Wealth Management

Source : darrowwealthmanagement.comIRS Gives Big Boost to HSA, HDHP Limits in 2024

Source : www.shrm.orgIRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.comIRS Makes Historical Increase to 2024 HSA Contribution Limits

Source : www.firstdollar.comHealth Savings Account (HSA) and High Deductible Health Plan (HDHP

Source : www.boltonusa.comIrs Deductible Limits 2024 IRS Announces HSA and HDHP Limits for 2024: However, even if one has exhausted the deduction limit In Interim Budget 2024, no change was made to the Section 80C limit, which permits certain insurance-related investments to be tax-exempt. . The IRS has announced several significant tax changes ahead of the 2024 tax season, including bigger standard deductions, modified tax brackets, 1099-K reporting changes, and updates to retirement .

]]>